Owning a business in the beauty and wellness industry is an exciting venture, full of

opportunities to create, innovate, and connect with clients on a personal level. However, along with the creative and therapeutic aspects of this industry come significant responsibilities that are crucial for long-term success. From choosing the right business structure to staying on top of taxes, marketing, and licensing requirements, here’s what you need to know as a business owner in this vibrant industry.

1. Choosing the Right Business Structure

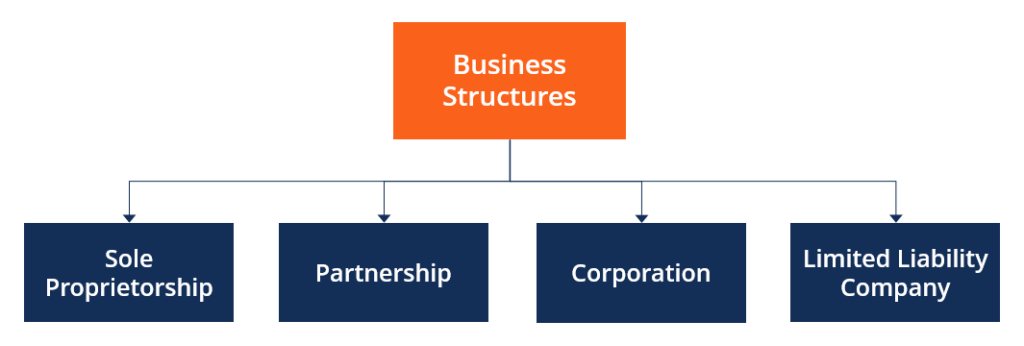

The foundation of any successful business starts with choosing the right structure. This decision impacts everything from how you file taxes to your level of personal liability and your ability to raise capital. Common business structures in the beauty and wellness industry include:

- Sole Proprietorship: The simplest form of business, where you are the sole owner. While easy to set up, it offers no personal liability protection.

- Limited Liability Company (LLC): A popular choice for beauty and wellness businesses, as it provides liability protection and is relatively easy to maintain.

- S Corporation (S Corp): Offers tax advantages by allowing profits to be passed directly to the owners’ personal income without being subject to corporate tax rates, potentially reducing your tax liability.

- Partnership: Ideal if you’re going into business with one or more partners, but it requires clear agreements to manage responsibilities and profits.

At Commas & Confirmations, we understand that each business is unique. It’s important to consult with a business advisor or legal expert to choose the structure that best suits your goals and circumstances.

2. Understanding and Managing Taxes

Taxes are a significant aspect of running a business, and staying on top of your obligations is crucial to avoid penalties and ensure financial health. As a business owner in the beauty and wellness industry, you’ll need to manage several tax responsibilities:

- Income Tax: Depending on your business structure, you may need to file personal income tax (for sole proprietorships or partnerships) or corporate tax (for LLCs or S Corps).

- Sales Tax: If you sell products, such as skincare or beauty items, you’ll need to collect and remit sales tax to your state’s tax authority.

- Employment Taxes: If you have employees, you’re responsible for withholding and paying employment taxes, including Social Security and Medicare.

Regular bookkeeping and working with a knowledgeable accountant are essential for keeping your finances in order. At Commas & Confirmations, we recommend setting aside time each month to review your financial statements and plan for upcoming tax obligations.

3. Marketing Your Business

In the competitive beauty and wellness industry, effective marketing is key to attracting and retaining clients. Your marketing strategy should be multi-faceted, combining both traditional methods and digital platforms to reach your target audience. Key marketing responsibilities include:

- Branding: Developing a strong, consistent brand that reflects your business values and appeals to your target market.

- Social Media Marketing: Utilizing platforms like Instagram, Facebook, and Pinterest to showcase your services, engage with clients, and build an online community.

- Website and SEO: Ensuring your website is user-friendly, visually appealing, and optimized for search engines so potential clients can easily find you online.

- Client Retention: Implementing strategies to keep your existing clients coming back, such as loyalty programs, referral discounts, and personalized communication.

At Commas & Confirmations, we believe in the power of a well-rounded marketing strategy that not only attracts new clients but also fosters long-term relationships with existing ones.

4. Keeping Up with License Requirements

The beauty and wellness industry is highly regulated, and staying compliant with licensing requirements is crucial for operating legally and maintaining your professional reputation.

Depending on your services, you may need to obtain and renew licenses such as:

- Cosmetology License: Required for professionals offering hair, skin, and nail services.

- Business License: Generally required by your city or county to legally operate your business.

- Health and Safety Compliance: Ensuring your business adheres to local health and safety regulations, including sanitation standards.

It’s important to keep track of renewal dates and any continuing education requirements needed to maintain your licenses. Failing to do so can result in fines, penalties, or even the suspension of your ability to operate.

5. Balancing Creativity with Responsibility

As a business owner in the beauty and wellness industry, you’re not just a creator or therapist – you’re also a manager, marketer, and strategist. Balancing your creative passion with the day-to-day responsibilities of running a business is essential for long-term success.

At Commas & Confirmations, we understand the unique challenges that come with being a business owner in this industry. That’s why we’re here to support you every step of the way, providing a space where you can focus on what you do best while knowing that your business is built on a solid foundation.

Conclusion

Owning a business in the beauty and wellness industry is both rewarding and challenging. By choosing the right business structure, managing your taxes effectively, marketing your services, and staying compliant with licensing requirements, you can create a thriving business that stands the test of time.

Remember, you don’t have to do it all alone. Whether you’re just starting out or looking to grow your existing business, seek out resources and professional advice to help you navigate the responsibilities of ownership. At Commas & Confirmations, we’re committed to helping you achieve your business goals while maintaining the highest standards of excellence in the

industry.